Lazada and the long slide in the e-commerce market

Once the largest e-commerce platform in Southeast Asia, how has Lazada lost its luster?

Lazada e-commerce platform

Lazada is an e-commerce company and is ranked among the Unicorns – A term for startups with a value of over $1 billion. Founded in 2012 by Maximilian Bittner and with help from the Rocket Internet group from Germany, Lazada was established to target the potential e-commerce market in Southeast Asian countries.

With the rapid growth of the market as well as the trend of acquisitions and mergers of large corporations. In 2015, Lazada was officially acquired by Alibaba group, one of the world's largest e-commerce corporations with Alibaba e-commerce platform.

Lazada operates with a business model operating in the direction of marketplace – an intermediary in the electronic buying and selling process. The model creates a two-way connection between sellers and buyers or another way to understand it is that Lazada is pursuing a B2B model.

Not simply acting as an intermediary in e-commerce, Lazada also provides parties with accompanying utilities such as logistics, payment and customer care,...

When Alibaba acquired Lazada

Southeast Asia is a very attractive market for global corporations and local companies in the e-commerce sector. The turning point in Internet and mobile penetration has allowed Southeast Asia's population to quickly adapt to online products and services.

The number of Internet users in Southeast Asia, especially in the six largest ASEAN countries, has contributed to creating a potential e-commerce market with many opportunities to exploit. In countries such as Indonesia, Thailand, Philippines, and Vietnam, e-commerce is still in its nascent stage, and is an important source of growth for ASEAN. The rapid development of technological infrastructure and increasing income levels of countries will facilitate the expansion of the E-commerce sector. With only 3% of the region's total retail sales made online, Southeast Asia is expected to offer huge growth potential.

In addition, the Southeast Asian market is quite clearly differentiated. Singapore is a developed country, it is very easy to establish an e-commerce business. However, at that time, the remaining markets faced many difficulties. Indonesia, Malaysia, Philippines, Thailand and Vietnam all have primitive technology with many problems and barriers. “The e-commerce markets in the region are still relatively untapped, and we see a very positive upward trajectory ahead,” said Daniel Zhang, CEO of Alibaba. We will continue to dedicate our resources to work in Southeast Asia through Lazada to capture these growth opportunities.”

Lazada was the largest e-commerce company in Southeast Asia at the time Alibaba bought a controlling stake in this company in 2016, operating in 6 key markets: Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam. In Vietnam, Lazada is currently one of the leading e-commerce sites with about 400,000 products and more than 6,000 sellers. During peak season, Lazada.vn website receives about 1.5 million visits/day.

However, Lazada also faces many challenges in expanding its market, for example, strong competitor from Indonesia Tokopedia. Previously, Tokopedia called for a new round of funding worth $147 million.

Furthermore, Lazada clearly understands how difficult it is to develop e-commerce in the Southeast Asian market. This is not at all easy. In very underdeveloped places, internet speeds and connections can be poor and the population is dispersed across thousands of islands like in Indonesia. Each country has its own language – and different laws, cultures, taxes, payment methods, customs clearance procedures and logistics setups. This is a big challenge for Lazada to conquer. Additionally, for much of Southeast Asia, infrastructure is poor or virtually non-existent. Roads make shipping goods online slow and expensive. Lazada needs a big investor to help transform itself.

All of those factors represent major barriers to e-commerce entry. Few e-commerce startups born in Southeast Asia have been able to expand across the region. Most businesses choose to stick with their home country, or maybe just venture into a familiar “neighbor” country. Therefore, Lazada is in dire need of capital support as well as experience from another "big man" with seniority in the field of e-commerce, here is Alibaba.

In addition, if Alibaba wants to build a model like Lazada in the Southeast Asian market, it will have to spend billions of dollars, but it may not be able to defeat other competitors. Therefore, the simplest and easiest way is to pour capital into Lazada. The acquisition of Lazada will help Alibaba access new, more fertile markets. Lazada is the top choice for the representation platform – connecting brands and distributors worldwide with 560 million consumers in Southeast Asia, in line with Alibaba's globalization strategy.

Dreams are far from reality

Southeast Asia is home to a large Chinese diaspora.

Alibaba entered Southeast Asia through Lazada - carrying in itself the DNA of Germany's Rocket Internet incubator, which is famous as a "copy factory", specializing in copying business models from Silicon Valley and then "applying them". use” them in other countries abroad.

By 2015, Lazada's GMV reached over $1.3 billion, surpassing Indonesian rival Tokopedia to become the region's leading e-commerce platform. Not long after, in April 2016, Alibaba bought 51% of Lazada shares, then continued to invest 1 billion USD in June 2017 to increase its ownership to 83%.

At first, Lazada focused mainly on the Indonesian market.

Jakarta's streets and alleys are filled with advertisements. Indonesia is considered the most promising market in Southeast Asia. The advertising strategy has been effective in planting in consumers' heads that e-commerce is much more accessible than they think.

An expert in the e-commerce industry said: “Rocket Internet has contributed significantly to the development of e-commerce in Southeast Asia. For the first time in history, someone is pouring money into this field."

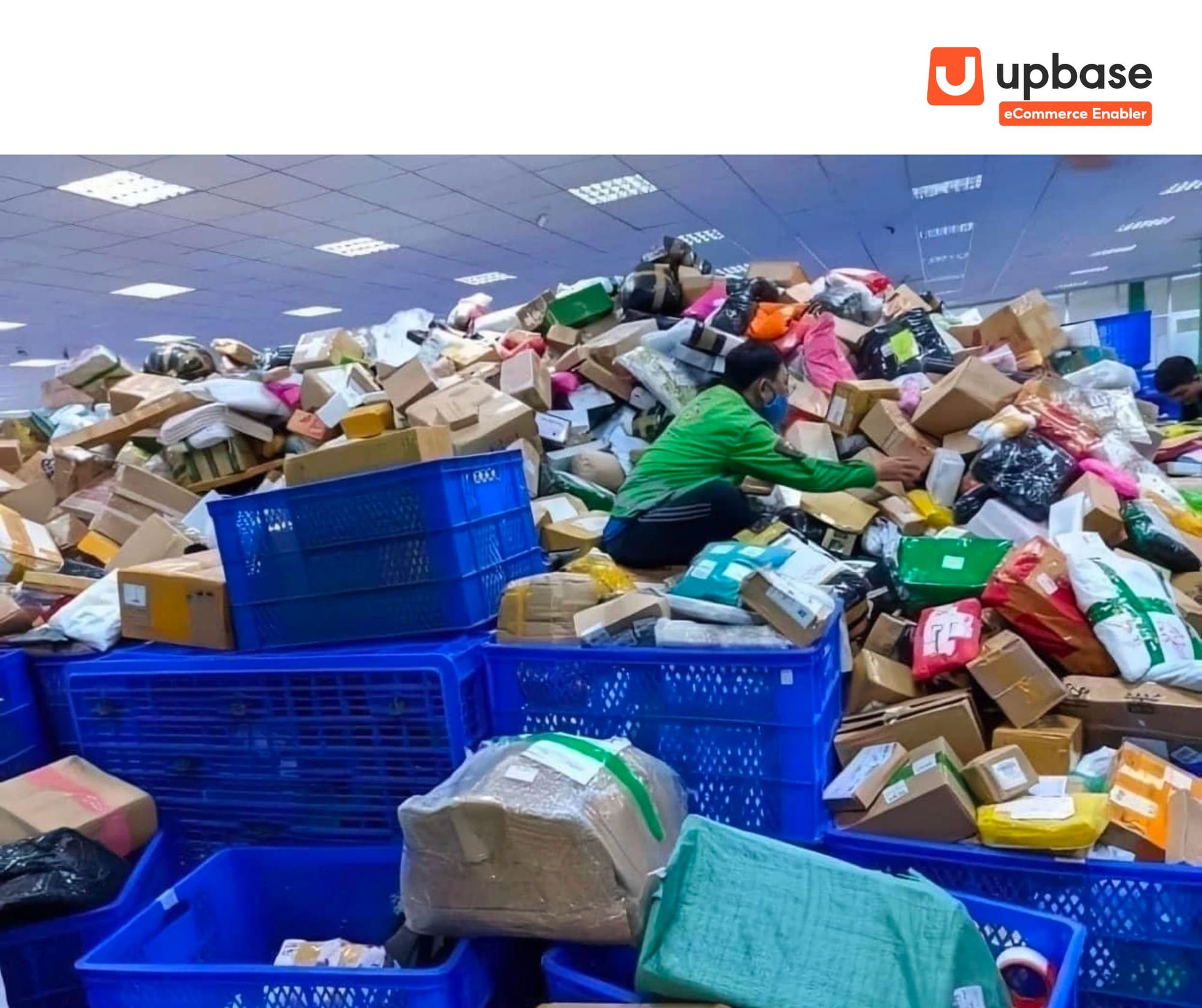

Just as Alibaba and JD.com launched their November 11 and June 18 shopping festivals in China, Lazada developed Harbolnas, its own sales event on December 12. Learning from the experience of the Chinese market, they began to focus on consumer electronics, managing warehousing, delivery and payment needs.Khi hoạt động của Lazada được mở rộng, đội ngũ quản lý bắt đầu tỏ ra lúng túng trong khi nhu cầu thương mại điện tử ngày càng tăng. Theo một người trong nội bộ Lazada, khi tổ chức các hoạt động khuyến mại, tình trạng hết hàng bất ngờ và giao hàng chậm trễ trở nên phổ biến do kho hàng chưa được tích hợp tốt.

The acquisition of Alibaba is expected to be a driving force for Lazada's development through a combination of finance and expertise.

The name of Jack Ma - founder of Alibaba and considered the most famous businessman in China at that time, made Lazada accept investment from Alibaba. With the new business partnership, Alibaba has closed its AliExpress cross-border business unit in Indonesia.

At that time, Shopee was hardly considered a threat. Shopee first launched in Taiwan in October 2015 and then expanded to Southeast Asia through Indonesia, Philippines and Vietnam.

Disagreement and conflict

After the acquisition, Alibaba promised Lazada that it would be able to maintain independent operations. However, disagreements and conflicts quickly broke out.

A Lazada insider said: “For example, in 2017, Cainiao – Alibaba's delivery service provider, wanted to build a 10,000 square meter warehouse, but Lazada wanted to test a 5,000 square meter warehouse first.

That year, Alibaba also wanted to bring some major international brands to Lazada, but Lazada employees felt these brands were too expensive and would not be well received by local consumers."

To ensure its decisions will be implemented, Alibaba transformed Lazada's internal structure. In March 2018, Mr. Peng Lei, former CEO of Ant Financial, assumed the position of CEO of Lazada. This is part of the binding terms for Alibaba to accept an investment of 2 billion USD in Lazada.

After the huge funding, Lazada did not take immediate action against competitors but instead began an internal cleanup process.

One advertising provider said that since Lazada is almost a wholly owned subsidiary of Alibaba, managing accounts across multiple countries is more complicated and until this can be sorted out then budgeting and advertising spending will almost come to a halt.

At the same time, local sellers noticed that the shop's interface changed overnight. A seller familiar with Alibaba's services in China said Lazada's new back-end system is almost a Taobao clone.

The upgrade plan that Alibaba has for Lazada is codenamed Voyage (journey), symbolizing the path towards new markets. Alibaba chief technology officer Zhang Jianfeng set out two main requirements:

First, the overall project must be completed before March 31 - the last day of Alibaba's fiscal year. Second, the plan must be achieved immediately.

Shop owners agree that the sales interface on Lazada needs to be upgraded because it is difficult to use, but this sudden change is something they do not want. Nearly all of Taobao's product and management features such as coupons, customer service and sales interface, etc. were launched at the same time, making it difficult for users to learn how to use them.

Lazada employees compare that applying the Alibaba system to the Southeast Asian market platform without tweaking is like installing a Boeing 747 engine on a classic car.

Besides the technical changes, hundreds of Alibaba's middle management employees have been appointed to various positions within Lazada. This move initially worried European managers at Lazada.

European leaders such as co-founder Charles Debonneuil and Chief Marketing Officer Tristan de Belloy soon left the company. Many others, including lower-level employees, followed suit.

The conflict was further exacerbated by the language barrier. There are dozens of languages spoken throughout Southeast Asia. Although English is the main language of communication in Singapore, Alibaba employees are generally not fluent and prefer to use Chinese to communicate with each other in small circles.

With three rounds of product upgrades, personnel adjustments, and accounting purges, Lazada's actual operations have stagnated.

Some Lazada partners said that they felt the company “did almost nothing” in the first six months after CEO Peng Lei arrived. Some shop owners in Malaysia said Lazada has even stopped some important promotions during this time.

Shopee launched a surprise attack

At the end of 2017, Shopee's parent company Garena changed its name to Sea Limited and listed on the New York Stock Exchange with a value of 6.3 billion USD.

“After the IPO, a lot of people sold their shares. They don't believe it can grow bigger," a Shopee investor shared.

In 2018, Shopee CEO Chris Feng seized the opportunity to launch an attack on Lazada's stagnation in Southeast Asia.

Currently, Shopee's market capitalization has exceeded 120 billion USD. Shopee staff said 80% of Sea Limited's stock price is supported by the growth potential of the platform, while 80% of Shopee's potential is supported by CEO Feng.

People close to Feng said he was the pioneer who left Lazada to join Garena in 2014 due to dissatisfaction with the situation at his old company. He founded Garena's mobile games division and founded Shopee a year later.

According to people familiar with him, he was highly respected by his subordinates and was considered an "extremely intelligent and extremely confident" person who "reacted quickly and had excellent memory."

Every two weeks, Feng holds large-scale meetings with the participation of dozens of individuals and can suddenly bring up data and information mentioned in previous meetings with ease.

Feng's experience and relationships at Lazada are considered very important to Shopee's development. For example, he was well aware of the chaotic situation inside Lazada in 2018 and seized the opportunity to launch an attack.

Like Lazada, Shopee started with an aggressive advertising strategy across Southeast Asia, with billboards posted at bus stops and along highways. They have brand representatives in many countries, such as Filipino boxer Manny Pacquiao and Malaysian singer Siti Nurhaliza.

According to a report from iPrice, in March 2018, the difference between the number of visits of Shopee and Lazada began to narrow.

CEO Feng focuses on the Indonesian market. An investor said: “When talking about population and size, Indonesia alone accounts for more than 40% of Southeast Asia. There is a saying that whoever wins in Indonesia will also succeed throughout Southeast Asia."

About half of Indonesia's population of 260 million is under 30 years old. The country has an average monthly income per capita of 230 USD. Indonesia's domestic industries are underdeveloped and cannot supply enough high-quality and low-cost goods to the domestic market.

Through connections in China, Shopee has attracted a large number of Indonesian users. One consumer said that the products sold on Shopee are quite diverse, including cosmetics, daily necessities, and small toys.

In China, e-commerce platforms allow factories to directly open stores and sell low-cost goods. Indonesia does not have many factories, but Chinese wholesalers from the mainland can buy and stock large quantities of goods.

Most of these traditional merchants have direct distribution channels, so getting them to sell on e-commerce is not easy. Before being acquired by Alibaba, Lazada tried to convince them, but because the company was not active in the Chinese business world, the efforts were unsuccessful.

After being taken over by Alibaba, Lazada remained uninterested in forming partnerships with these wholesalers.

Many people who worked at Lazada at the time said the group's focus was on building its brand and bringing in items that could elevate consumer trends in Southeast Asia. Alibaba dedicates their resources and time to introduce more international brands and help Alibaba get more overseas sales on Singles' Day.

Meanwhile, each year Shopee CEO spends about 80% of his time in Indonesia. He even learned the local language. His and his team's tireless efforts eventually enticed wholesalers to use Shopee's platform and secured a supply of cheap goods.

Stop subsidizing delivery

Besides the uneven availability of goods in Southeast Asia, logistics is a huge problem that cannot be solved overnight.

In 2017, express delivery services in Southeast Asia were not only expensive but also slow. It usually takes 7 days for users to receive online purchases. Goods purchased from abroad can take up to a year to ship.

Shop owners benefit from this delivery policy. For example, if an Indonesian cross-border seller receives an order of 6.26 USD, they will receive a shipping allowance of 3.48 USD.

Shopee burns money on these subsidies in exchange for massive traffic and rapid sales growth - which directly boosts the domestic express delivery industry.

The two largest express delivery companies in Indonesia, JNW and J&T, are the main beneficiaries. A J&T employee in Indonesia said that the density of J&T stores in Jakarta increased to one every 5 km in 2018.

To transport more goods to Indonesia, a country with more than 1,000 islands, J&T has purchased a number of cargo ships. By mid-2018, most products purchased on Shopee were delivered within 3 days, some even within two days.

Stopping the delivery subsidy caused Lazada to lose a number of customers as well as sellers to Shopee.

Covid-19 pandemic

The pandemic has accelerated the growth of the e-commerce industry but tilted it towards Alibaba's competitors. After getting ahead in 2019, Shopee introduced Shopee Mall, where large, reputable brands can open online stores. They also invested $192.9 million in marketing and advertising activities, including fees for soccer star Cristiano Ronaldo to act as a brand representative.

In mid-2019, Lazada switched to a loss-cutting strategy.

Some advertising channels said that since then, Shopee has mainly bought CPI ads (cost per install - paying the advertising channel every time a user downloads the app), while Lazada has mainly bought buy CPR ads (cost per result - pay for the ad channel only once when the user has purchased something using the app).

This reflects the changing market strategies of both companies, with Shopee still investing heavily in user acquisition, while Lazada focuses on controlling costs.

Mr. Zhang Yong no longer flies to Singapore every month. Alibaba delegated responsibility to people who understand the Southeast Asian market better like Li Chun, who has worked for Lazada for more than three years.

Li graduated from Beijing University, worked for eBay in China and then worked at the headquarters in the US, with a total of 12 years of experience. After returning to China in 2014, he joined Alibaba, holding the position of CTO in the B2B department.

Two years later, he took on the position of CEO of Lazada Indonesia again in July 2019. This is the time when Lazada fell into crisis when all indicators dropped to their lowest.

Mr. Li spends half of his time in Jakarta. One supplier said that Li is focused on "putting aside all disputes and moving forward together". Lazada no longer imposes restrictive conditions on its suppliers. The company also became more active in soliciting import and export units. This allows Lazada to attract support from its sellers and delivery facilities.

Li's leadership strategy has yielded results. According to App Annie, from June 2019 to May 2020, although Tokopedia and Shoppe were still the most popular apps in Indonesia, Lazada's app downloads still topped the chart.

In 06/2020, Li was promoted to CEO of Lazada.

However, Lazada's growth momentum encountered an obstacle: the pandemic. COVID-19 gives competitors the opportunity to gain a large base of paying customers. By the third quarter of 2020, monthly visits to Shopee were 4 times more than those of Lazada in Southeast Asia and 20 times more than those of JD.com.

Lockdowns across Southeast Asian cities have not stopped Shopee from investing in large-scale marketing campaigns. For example, the largest screen at Orchid Garden Shopping Center in downtown Jakarta continues to display Shopee ads prominently, even when fewer people pass by.

Lazada is slower. An employee of this platform in Indonesia said that after the pandemic broke out in Jakarta in April 2020, Alibaba withdrew almost all of its employees.

By the third quarter of 2020, monthly visits to Shopee were nearly 4 times that of Lazada, with the market value of parent company Sea Limited equal to 1/5 of Alibaba's capitalization.